Bull Market Anniversary: What's Changed in 7 Years?

Last week marked the seventh anniversary of the U.S. stock market bottom on March 9, 2009. To put the recent volatility into perspective, let's take a look at what has changed over the last seven years:

The S&P 500 has risen substantially

From the depths of the bear market, the S&P 500 grew a significant amount through its mid-May 2015 high, surpassing previous historic highs. Since then, stocks have lost some value, hit by global economic forces. However, it's a testament to how resilient U.S. markets are that they have lost so little when faced with serious concerns about global growth.

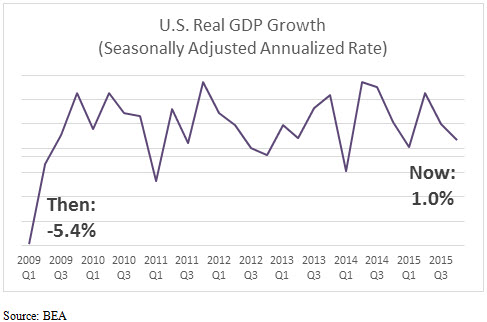

Economic growth has regained speed

The economy has also made major strides in the last seven years. Taking a look at this chart, we can see that in the first quarter of 2009, the economy contracted by 5.4%, putting it firmly in recession territory. In contrast, the latest data from Q4 2015 shows that the economy grew by 1.0%. Naturally we're not too excited about that level of growth and the potential is much higher, but we can see that the economy has grown substantially overall since 2009.

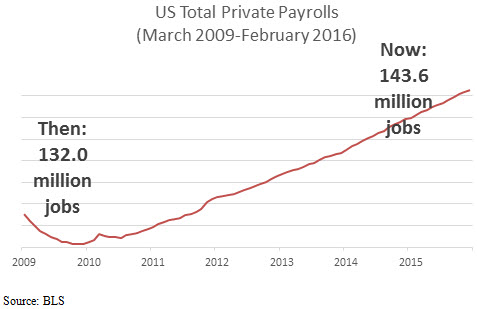

Millions of Americans have returned to work

Over the last seven years, the economy has gained over 11.5 million jobs - more than the 8.7 million jobs lost in the recession. While much of the growth has been in relatively low-paying industries, the improvement has been broad-based, indicating that many sectors of the economy are hiring.

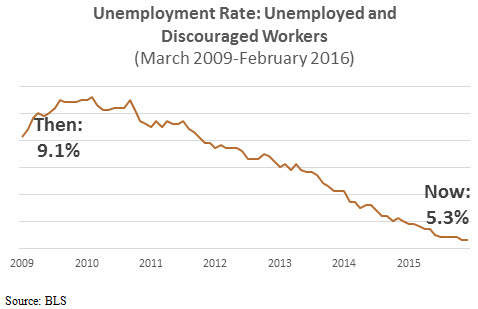

We can also see that the number of both unemployed and "discouraged" workers has been steadily declining since peaking in mid-2010. This is a broader measure of unemployment because it also captures those who are not looking for jobs because they believe no work is available. As the labor market improved, more Americans gained confidence in their prospects and returned to the labor market.

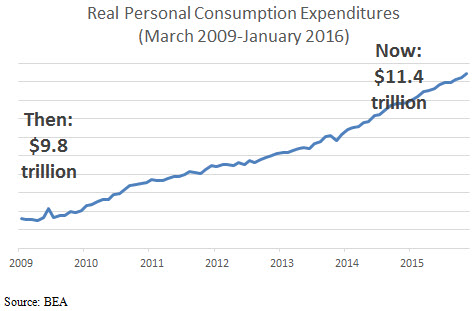

Americans are driving economic activity by spending

In tandem with the increase in available work, Americans opened their wallets and started spending again, increasing personal spending by 15.9% over the last seven years. Since consumer spending accounts for about 70% of domestic economic activity, it represents a driving force for our economy. Though we don't have February or March data yet, consumer spending still appears to be on a healthy trajectory.

The Here and Now

With all of the talk of recession and bear markets, it can be easy to lose sight of just how far we've come during this rally. Of course it's not possible to accurately time the exact beginning or end of any market cycle, and no one can predict where markets will go later this year. But what we can do is regularly measure underlying fundamental and technical readings and make prudent adjustments to investment strategies as needed.

The week ahead is packed with data. In addition, investors have two central bank meetings in what the media is calling "bank-a-palooza," a series of meetings by the ECB, Federal Reserve, and Bank of Japan to decide monetary policy. While the Fed isn't expected to raise interest rates again next week, officials could provide valuable insight into the timing of future rate hikes. If economic data supports further increases, investors could confront the possibility of multiple rate hikes this year.

Need some advice?

We're here to help. Get in touch with us and we'll do our best to guide you in the right direction.