How Should Unemployment Be Measured ?

Among last week's major events was a surprisingly good July jobs report. Last month, the economy added 255,000 new jobs, beating expectations of 180,000 jobs. Even better, the gains were broad-based and the labor force participation rate (an area of concern because fewer people in our population were actively participating in the labor force) ticked upward. Overall, it was positive news on the strength of the labor market.

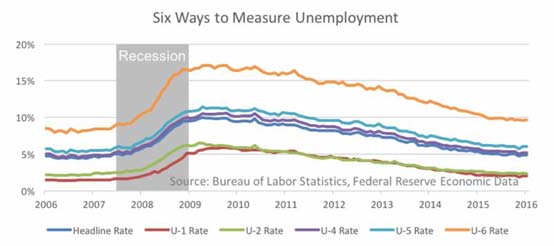

Headline unemployment remained stable at 4.9%, but that single number hides a lot of complexity. Let's dig a little deeper. The chart below shows six different measures of unemployment, each slicing the data in a different way.

The U-6 unemployment rate is the most comprehensive, showing total unemployed, marginally attached workers (discouraged workers and those considered barely employed) and those total employed part time for economic reasons.

You can see that all measures rose during the recession and have been steadily dropping ever since. While headline unemployment (U-3 unemployment in official parlance) stands at 4.9%, U-6 is still at 9.7% (almost two percentage points higher than the pre-recession low of 7.9% achieved in 2006), indicating there are many people who haven't participated fully in the labor market recovery; however, the rate has fallen significantly from the 17.1%high it reached in 2009. All told, most areas of the labor market are still making gains.

Britain's central bank moved to lower interest rates to fight the Brexit blues. The Bank of England cut interest rates for the first time in nearly seven years and announced an aggressive round of bond purchases to stimulate economic activity. The bank is moving quickly to head off a possible economic blow back from Britain's vote to exit the European Union. Will the Federal Reserve raise rates while one of our major trading partners is going the other way? Plenty of expert opinions make the case for both answers to that question, so it will be interesting to see how it unfolds.

We will keep you updated as always.

Need some advice?

We're here to help. Get in touch with us and we'll do our best to guide you in the right direction.