STILL Not So Happy New Year for Stocks

We don’t normally like to comment frequently on short term movements of the global investment markets, but with the stellar results for U.S. stocks in 2013 being followed by a disappointing start to 2014, we felt the need to continue providing perspective to counteract the dramatic reports you are probably seeing in the financial media.

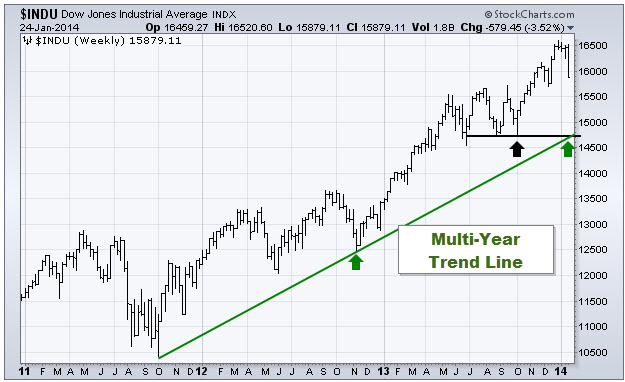

The following was our statement made in last week’s update that still stands – “We have discussed several times that 2014 could very well bring the first meaningful drawdown in the U.S. stock market that we have seen in the last 3 years, and that such a move would be normal and actually healthy as long as it is contained.”

After that we showed graphically what a 5-10% drawdown in the Dow Jones Industrial Average could look like from current levels, so today let’s update that graphic. The chart below shows the S&P 500 Index (containing mostly large capitalization U.S. stocks) for the last 2 years and marks the approximate levels for 5% and 10% downward moves from the recent highs seen in January.

There are two main points to consider on this graph:

1. The recent drawdown has already passed the 5% mark (currently around 6%) and if it continues, a 10% move is still a substantial distance away.

2. When viewed on this multi-year chart, the current drawdown does not look out of line with similar moves in 2013, and so far it is still smaller than both of the 2012 downward moves (-10.4% in May and -8.9% in October).

Additionally, and more importantly, all of our client accounts have lost significantly less ground so far this year than the U.S. stock market, primarily due to our global allocation in a wide variety of asset classes and our fund selection process. The recent market action has not yet caused us to make any significant allocation changes, but naturally we are monitoring things closely to look both for dangers and opportunities in the current environment. No one actually knows what the next day, week, month or longer holds for U.S. stocks or for any other asset class, but we can and will be paying attention and be open to making prudent adjustments as conditions warrant.

The following is our closing statement from last week, and it still stands as well – “Regardless of exactly how the recent action plays out, it is important to remember that it has been a long run upwards since a drawdown of 10% or more occurred in the U.S. stock market. Whatever dramatic headlines the financial media might generate if that does occur now, such a move should be absorbed with the knowledge that some type of negative movement is overdue and, if contained, would be helpful in maintaining the longer term upward direction of equities.”

Click on the below images to see the larger versions:

Need some advice?

We're here to help. Get in touch with us and we'll do our best to guide you in the right direction.