What Happens in Vegas ...

Earlier this week, our firm attended one of the premier annual conferences for independent financial advisors. It is produced by our SEC compliance consulting firm, Market Counsel, and this year was held in Las Vegas. This was our first appearance at this conference and it did not disappoint, with an attendee list that included most of the best known names in our business, as well as many notable outsiders. Speakers included the likes of Tony Robbins, Eliot Spitzer and former SEC Chairmen Christopher Cox and Harvey Pitt. We also had the opportunity to chat personally with Ron Insana and Melissa Lee of CNBC fame and the always interesting Mark Cuban. It was nothing short of a fantastic conference, and out of the many themes we took away, we wanted to share two of them today.

The first is that in today's social media world of Twitter and Facebook, and with everyone carrying a smart phone in their pocket, what happens in Vegas does NOT stay in Vegas. During each conference presentation, there was a live Twitter feed from the attendees scrolling on a big screen in the room. We were stunned to see that almost as soon as people on stage said anything remotely interesting, it was almost immediately quoted and sent out via Twitter by many attendees. The other interesting takeaway was how utterly useless the content was on most of the Twitter messages. It reminded us that in this age of information overload, our communications to you should be brief and meaningful, and we will continue striving toward that goal.

The second theme was the overwhelming focus at the conference on how firms are adopting new technologies and using them to grow rapidly. It is amazing how fast the available technology is changing, and you know our firm likes to bring new tech tools into our procedures when they make sense for our business model. But there was a conspicuous absence of any sessions addressing investment strategy. Maybe it was because that area is so very unique to each firm and impossible to agree on, but it seemed to us that investment strategy innovation was just not as high on the priority list for attendees as other items.

For our firm, investment strategy evaluation and innovation always maintain high priority spots on our company objectives. In fact, our research this year will result in the introduction of additional investment strategies in 2015, and you will be hearing more about that as we start the New Year. Speaking of investing, let's look at the current equity market picture as it heads into the end of the year.

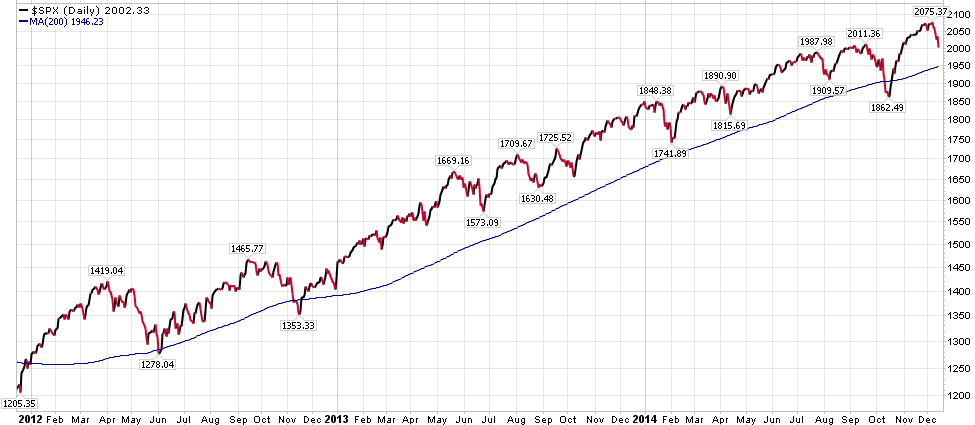

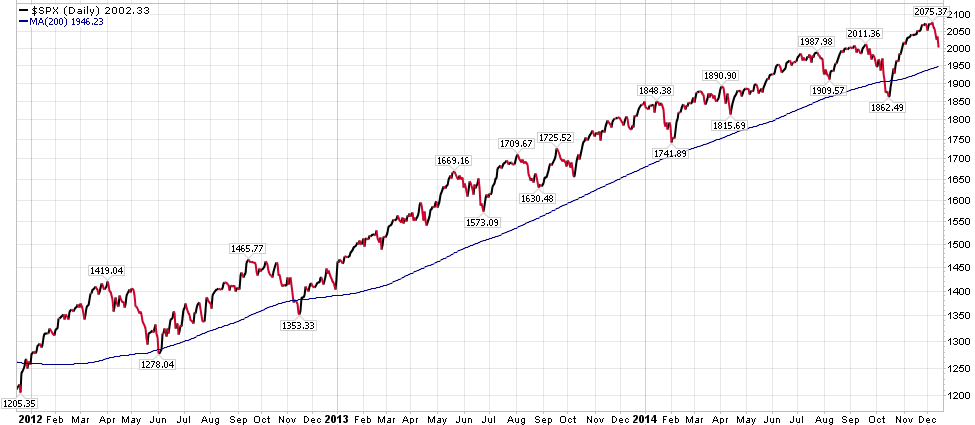

Historically December has been a pretty strong month for the equity markets. Since 1950, the S&P 500 has seen a positive return for December in 49 years and a negative return in 15 years. That equates to a positive return 76.5% of the time and and average monthly gain of 1.62% during that time span. However, history also indicates that even in positive December years, there is often weakness in the first two weeks of December, and we are likely seeing that seasonal weakness over this past week. As you can see in the chart below of the S&P 500, the recent selling pressure in equities does not look out of the ordinary when viewed in a 3 year window, and in fact it actually looks necessary to prepare for the next leg up. If a year-end or new year rally does not materialize, then further evaluation would be warranted, but for now it is prudent to be patient until we see how this year ends and the next year begins. Also, keep in mind that the benchmark for our globally diversified, multi-asset class allocations is not solely the U.S. equity market, and that your returns will only have a mild level of correlation to U.S. stocks over any given time frame. We will cover all of this much more in our quarterly client video update in early January.

As an important additional note, if you have been considering adding new money to any of your accounts under our management, the recent weakness might be giving you an attractive time for doing that. Please contact us if you wish to discuss this further.

Thank you as always for your trust and confidence and we will be back in touch very soon!

Need some advice?

We're here to help. Get in touch with us and we'll do our best to guide you in the right direction.